Latest Car Maintenance Comparisons Between Plug-In Cars And ICE (Internal Combustion Engine) Cars

Friday, 26. May 2023

While many organisations are electrifying their fleets with the main aim of reducing carbon emissions, cost still matters.

Traditionally, the typically higher purchase or lease rates of a battery electric vehicle (BEV) compared with an internal combustion engine (ICE) model have been mitigated by factors such as lower fuel and/or charging costs.

However, this advantage has been eroded significantly through the soaring cost of electricity.

Another traditional benefit for BEVs has been lower service, maintenance and repair (SMR) outlay.

It has been widely supposed they will deliver uniform SMR benefits over petrol and diesel vehicles because they have fewer mechanical parts, minimising the likelihood of breakdown and requiring less routine maintenance.

But with growing numbers of BEVs on the road giving more data in this area, does this expectation still hold true?

Yes, says Vincent St Claire, managing director of Fleet Assist, which has a network of 5,200 franchised and independent garages, but with a caveat.

“All the indicators are strong that SMR for BEVs will continue to be less than that for ICE vehicles,” he adds.

“However, while we are now in a period after the pandemic where BEVs are in proper real world use and we are seeing vehicles doing higher mileage than they’ve ever done, it is still a small sample and until we get a bigger data set in terms of numbers of BEVs, we can’t say with a high degree of conviction the issue is settled.”

In the first 10 months of last year, Fleet Assist saw the number of BEV SMR jobs on its network increase by 73% compared with the same period in 2021, but they still accounted for just 9% of its overall vehicle parc.

The company’s average cost of BEV SMR in 2022 was £171, 40% lower than all other vehicle types including ICE and hybrid (£243) compared with the previous year.

But the average age of ICE vehicles analysed last year was three-and-a-half years older than the equivalent BEV, which was likely due to the ICE vehicles being retained by fleets due to extended contracts and vehicle availability.

This combination would result in larger jobs and major components being fitted to ICE vehicles so has to be taken into consideration, says St Claire.

The most used components in ICE vehicles were, in order: brake pads, brake discs, bulbs, oil filters and pollen filters.

For BEVs these were pollen filters, bulbs, key fob batteries, wipers and brake fluid.

Rivus reports overall SMR costs for fully electric LCVs are 20% lower than for ICE equivalents, while the service costs are 65% lower.

The company has measured the costs by comparing BEVs seen by its service network with ICE vehicles which are from the same model line-up and registered at the same time.

“Given the LCV learnings we’ve had from our garages so far, the high-level figures do look quite positive,” says Sarah Gray, head of electric vehicles and alternative fuel vehicles at Rivus.

“When you put all the costs together in a bucket to have a look at how these sets of vehicles have performed, we’re looking at about 20% less cost overall at the moment for EVs, which is really positive news.

“What I would say, however, is we’re still in really early days. For example, the e-Vivaro has probably only been out for two-and-a-half years whereas the ICE Vivaro has probably been around for 20 years.

“When they come into our garage over a longer period of time we can start predicting what maintenance they might need, whether we need to make any changes in terms of service intervals etc.

“At the moment with BEVs, they may have just been in for one service and that could be a routine check and nothing is required.

“When we get further down the line and we start servicing vehicles in year three or year four, I don’t expect the savings to be as much as they seem now, but we’ll wait and see how they perform.”

Real world data from Epyx, however, shows a mixed picture for EV servicing costs compared with their petrol and diesel counterparts, with results heavily dependent on the vehicle model.

“At the outset, it should be underlined that fairly substantial caveats must be applied to this data,” says Charlie Brooks, strategy director at Epyx.

“In terms of the information available on 1link Service Network, there remain relatively few EVs of relevant ages and mileages.

“For the comparisons we’re quoting here, there are only around 170 vehicles in total. However, it shows, perhaps surprisingly, that the emerging picture is more mixed than might be expected.”

Its figures show the average cost of a service for a widely used battery electric hatchback over three years/25-30,000 miles was £164. Over the same cycle, an ICE hatchback was £220. The average repair cost for a fully-electric hatchback was £70, £10 more than its ICE counterpart.

For a large prestige SUV over two years/20-30,000 miles, the average service cost was also £164 for BEV models, and £279 for an ICE. As with the hatchbacks, the cost of repairs for an electric SUV (£81) is slightly more than an ICE SUV (£70).

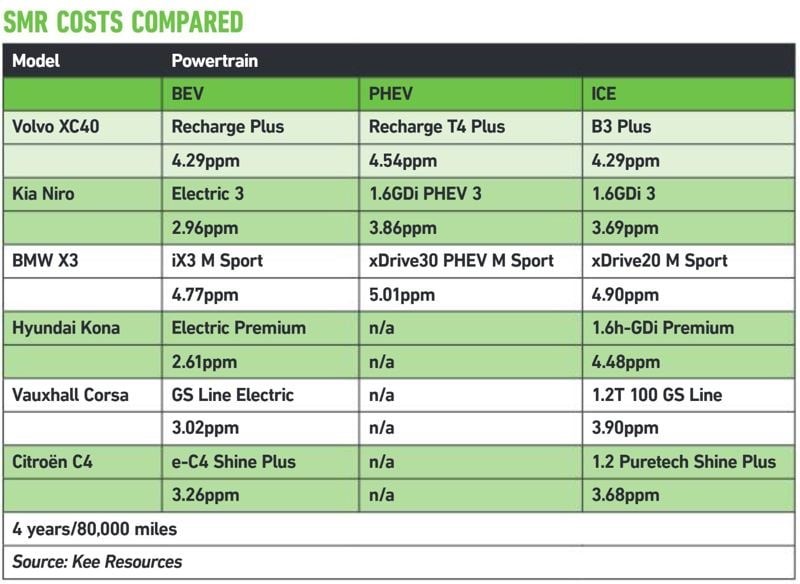

Analysis of data from Kee Resources, which is used in the Fleet News company car tax calculator, reflects a mixed picture (see table, above).

Over a replacement cycle of four years/80,000 miles, a petrol Volvo XC40 B3 Plus has an SMR cost of 4.29 pence per mile (ppm): exactly the same as its Recharge Plus fully-electric sibling.

It is a similar story for the BMW X3: the fully electric iX3 M Sport will cost 4.77ppm in SMR, with the petrol xDrive20 M Sport at 4.90ppm.

There are still significant savings to be had with some models, however. A Hyundai Kona Electric Premium will cost 2.61ppm in SMR, 42% less than for the petrol 1.6h-GDi Premium.

“Broadly, while workshop costs for some EVs represent substantial savings over their petrol and diesel equivalents, this cannot be assumed,” says Brooks.

“Also, the number of times that EVs visit garages for maintenance or repair and the amount of time they spend unavailable off-road are consistently similar to ICE vehicles – and those servicing factors very much represent a substantial cost to business.”

Epyx data shows the electric hatchback averaged 5.7 visits to service outlets and spent 3.2 days off-road due to SMR issues.

These figures are very similar to the petrol version of the same model, which had 5.0 service visits and 4.5 days off-road.

The electric SUV delivered 4.1 visits compared with its petrol counterpart’s 4.0, but its 3.4 days off-road was superior to the ICE vehicle’s 4.9.

“What the data doesn’t tell us at this stage is why this is the case. There could be good reasons,” says Brooks.

“For example, EVs remain a relatively new technology when operated on a large scale and what we are seeing could be teething problems that may range from workshops being unfamiliar with these types of vehicles through to parts not being readily available.

“However, the bottom line at this stage is that fleet managers should not automatically believe that, in adopting EVs, they are going to see SMR benefits with every model.

“That situation may well change over time, but these comparisons show that we are not there yet.”

Tyres

Conventional wisdom has been that the tyre costs for a BEV would be greater than for an ICE vehicle because their extra weight and high instant torque would lead to higher wear.

This has been supported by data from Rivus, which has found tyre costs are 15% greater for a fully-electric van than its ICE counterpart, but wider evidence is inconclusive.

“If electric cars were fitted with the same tyres as ordinary vehicles, the rates of wear would be great: but they aren’t,” says a Kwik Fit spokesman.

“Electric car tyres are built to withstand the pressure of the increased battery weight and manufacturer improved not only the rubber compound and sidewall strength, but also the tread and groove design for resilience.

“As result, they are more expensive than regular tyres, but due to their strain-absorbing structure, they will wear down less quickly.”

Michelin says conventional tyres on a BEV would probably wear out around 20% faster than an EV-specific tyre.

Kwik Fit adds: “It seems then, that EV tyres do last longer, but this result comes with a caveat.

“Not only are EV tyres more expensive, but the rate of wear has a lot more to do with the driver than the tyre itself.”

Excessive braking, mileage, wheel alignment and tyre monitoring are the biggest influence on tyre lifespan.

Research released in March by Epyx found tyres for electric company cars are on average both bigger and more expensive than those for petrol or diesel equivalents.

The company found the average replacement tyre fitted to an EV is 18.59 inches and costs £207 while, for ICE cars, the corresponding figures are 17.40 inches and £130.

Accident repairs

As with servicing and maintenance, the sample size of BEVs which have been involved in collisions is too small over too short a period to draw definitive conclusions.

However, in its analysis, Rivus has found the cost of repairing a fully-electric car after a collision is around 25% more than for an ICE equivalent, while this figure is around 55% for LCVs.

Its figures show the average accident repair cost of an ICE car is £1,155, a BEV £1,327 and a hybrid £1,733. For LCVs, the costs are £1,545 and £2,394 for ICE and electric models respectively.

Vehicle off-road time is also greater for EVs. Rivus analysis shows the average time off the road for a battery electric car is 10.9 days, hybrid 16 and an ICE car 8.9. For LCVs, this is 17.7 and 9.3 for electric and ICE respectively.

“In many circumstances, EV accident repair is no different from ICE vehicles,” says Adrian Watson, head of engineering at Thatcham Research.

“But under the hood lie everyday essentials, such as safe, cost-effective, timely post-accident repair and the surrounding claims process so critical to putting any new vehicle on the road.

“And nowhere is the difference between EV and ICE more clearly underlined than in the insurance claim chain.”

Watson says because EV batteries are expensive, OEMs rigorously protect them within crash structures which means they will rarely be affected by low-speed impacts.

However, challenges arise when the battery is involved, either directly or indirectly as a result of a collision, or indirectly when the high voltage system becomes associated with the repair.

Thatcham Research is to lead an Innovate UK-funded project focused on EV collision repair and salvage processes and their impact on insurance claims and their associated costs.

Other project partners include vehicle salvage, dismantling and recycling specialist Synetiq and LV= General Insurance.

In the first phase, the five-month project will focus on identifying where the claims workflow is different for EVs, revealing potential pain points.

Following this, Thatcham will use the findings to determine where more detailed work may be required in the future.

SMR industry facing EV skills shortage

A further issue facing the SMR industry is ensuring there are enough trained mechanics to work on electric vehicles (EVs) in the future.

At the end of last year, cross-party think-tank Social Market Foundation estimated Britain is facing a critical shortage of qualified technicians, who need specialist training to work on EVs due to the different technologies and potentially lethal high voltages involved.

In its A Vehicle for Change report, the organisation says that, by 2027, there will not be enough qualified mechanics to maintain all of Britain’s EVs, which risks driving up service costs and potentially leaving some drivers unable to have their vehicles maintained properly.

This followed a similar warning from the Institute of the Motoring Industry (IMI), which warned only 11% of technicians in the UK are qualified to work safely on EVs.

According to the IMI, there could be a shortfall of 25,100 qualified technicians by 2027.

“The skilled EV workforce is not keeping up with the sales of BEV, plug-in hybrid and hybrid vehicles,” says Steve Nash, chief executive of the IMI.

“While manufacturers and their franchised dealers are committed to EV training, lack of funding means independents risk being left out in the cold and this risks consumer choice being restricted and EV servicing costs rising.”

The IMI is calling on the Government for £15 million funding to help get more technicians ‘EV ready’. By Graham Hill thanks to Fleet News