General Increase In Car Size Creates Parking Problems

Friday, 8. January 2021

Cars have grown by as much as 55% since the 1970s, leaving drivers little room to squeeze out of them in parking bays that have remained the same size, new research suggests.

Parking guidelines haven’t changed in 50 years, says CarGurus.co.uk, which conducted the research.

The recommended 2.4m x 4.8m leaves drivers little room to get out their parked car, it says, which is contributing to the thousands of incidents that occur in car parks every year, costing drivers and fleets dear.

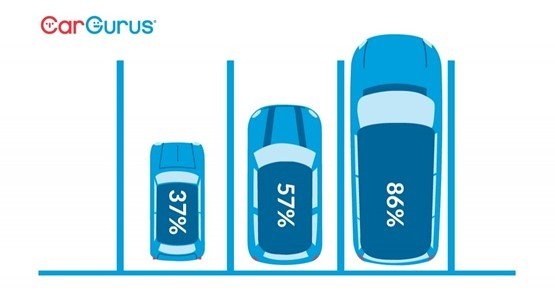

In the most extreme example, CarGurus research found that today’s Land Rover Range Rover takes up to 86% of the standard parking space, leaving just 21cm of room for drivers to get out. In contrast, the 1970s model took up just 69% – the same footprint as today’s Ford Focus.

Research by the automotive shopping site, compared the most popular cars currently on UK roads, which had an equivalent available in the 1970s, showing how their footprint on the typical parking bay has grown.

As cars have grown, many of the most popular vehicles are leaving little space for drivers to get out. For example, the 10th generation Honda Civic, one of the biggest growers from its first generation, now takes up 71% of the parking space, ballooning from 49% in the first generation and leaving just 30cm of space for drivers to get out.

Chris Knapman, editor at CarGurus.co.uk, said: “It’s understandable why cars have grown so much over the years, and the dramatically improved safety standards of modern cars versus those of years gone by is an obvious benefit. However, as many motorists will no doubt confirm, it’s disappointing that parking space guidelines haven’t been updated accordingly.”

The Mini Hatch was the biggest grower on the list; 55% larger and taking up 20% more of the typical parking space than the original that was produced between 1959 and 2000. This means it offers 16cm less room for drivers to get out.

“Many of the latest cars are at least available with technology to help with parking,” Chris Knapman, CarGurus.co.uk

The Audi A4, BMW 3 Series, BMW 5 Series, Ford Focus, Ford Mondeo, Mercedes E-class, Peugeot 308, Vauxhall Insignia and VW Passat have also all grown significantly to leave drivers with less than 30cm space to exit the vehicle.

Despite many cars already proving to be a tight fit in standard parking spaces, the growth spurt appears to be unrelenting with CarGurus’ research finding cars are continuing to grow by an average of nearly 3% from generation to generation6, meaning squeezing out of parking spaces will continue to become more and more challenging for drivers.

Knapman said: “Many of the latest cars are at least available with technology to help with parking, including parking sensors, reversing cameras, 360-degree view cameras and automatic parallel and bay parking functions.

“Some even equip cars with features to help prevent car park damage, such as door edge protectors and Citroën’s Airbump Technology.

“However, it is of course worth noting that no matter how easy the technology makes it to park, if the space is too small for your car none of it will help you to physically squeeze out of the driver’s seat.”

CarGurus.co.uk compared the dimensions of the 23 most popular cars on the road today which had an equivalent available in the 1970s.

CarGurus’ Car Dimensions Comparison: 1970s vs. 2020

| Ranking | 1970s Make & Model | Space to open door (cm) | Area of parking space used up | Today’s Make & Model | Space to open door (cm) | Area of parking space used up | % increase in area |

| 1 | Morris/Austin/ Rover Mini (1959-2000) | 50 | 37% | MINI Hatch 3dr (2014-) | 34 | 57% | 55% |

| 2 | Fiat 500 (1957-1975) | 54 | 34% | Fiat 500 (2007-) | 39 | 50% | 47% |

| 3 | Honda Civic 1st Gen (1972-1979) | 45 | 49% | Honda Civic 10th Gen (2016-) | 30 | 71% | 44% |

| 4 | Peugeot 104 (1972-1988) | 44 | 43% | Peugeot 208 2nd Gen (2019-) | 33 | 61% | 42% |

| 5 | Renault 5 (1972-1985) | 44 | 47% | Renault Clio V (2019-) | 30 | 63% | 36% |

| 6 | Mazda 323 3rd Gen (1977-1980) | 40 | 53% | Mazda 3 4th Gen (2019-) | 30 | 70% | 31% |

| 7 | Audi 80 (1972-1978) | 40 | 58% | Audi A4 B9 (2016-) | 28 | 76% | 30% |

| 8 | VW Passat B1 (1973-1981) | 40 | 58% | VW Passat B8 (2015-) | 28 | 76% | 30% |

| 9 | Vauxhall Nova A (1982-1993) | 43 | 48% | Vauxhall Corsa F (2019-) | 32 | 62% | 29% |

| 10 | VW Golf MK1 (1974-1983) | 40 | 52% | VW Golf MK8 (2020-) | 31 | 67% | 28% |

| 11 | Ford Escort MKII (1974-1980) | 42 | 54% | Ford Focus MKIV (2018-) | 29 | 69% | 28% |

| 12 | VW Polo MK1 (1975-1981) | 42 | 49% | VW Polo MK6 (2018-) | 32 | 62% | 26% |

| 13 | Ford Fiesta MK1 (1976-1983) | 42 | 48% | Ford Fiesta MK8 (2017-) | 33 | 61% | 25% |

| 14 | Range Rover Classic (1969-1996) | 31 | 69% | Range Rover L405 (2012-) | 21 | 86% | 25% |

| 15 | Toyota Corolla 3rd Gen (1974-1981) | 42 | 54% | Toyota Corolla 12th Gen (2019-) | 31 | 68% | 25% |

| 16 | Ford Cortina MKIV (1976-1979) | 35 | 64% | Ford Mondeo MKIV (2014-) | 27 | 78% | 22% |

| 17 | Vauxhall Cavalier MK1 (1975-1981) | 37 | 64% | Vauxhall Insignia B (2017-) | 27 | 79% | 24% |

| 18 | BMW 3 Series E21 (1975-1983) | 40 | 61% | BMW 3 Series G20 (2019-) | 29 | 75% | 23% |

| 19 | Vauxhall Astra MK1 (1979-1984) | 38 | 57% | Vauxhall Astra MK7 (2015-) | 30 | 69% | 21% |

| 20 | Peugeot 304 (1969-1980) | 42 | 56% | Peugeot 308 2nd Gen (2013-) | 29 | 67% | 19% |

| 21 | BMW 5 Series E12 (1972-1981) | 36 | 68% | BMW 5 Series G30 (2017-) | 27 | 80% | 17% |

| 22 | Mercedes 190 (1982-1988) | 36 | 64% | Mercedes C-class 4th Gen (2014-) | 30 | 74% | 14% |

| 23 | Mercedes W123 (1976-1986) | 31 | 73% | Mercedes E-class 5th Gen (2017-) | 27 | 79% | 8% |

By Graham Hill thanks to Fleet News