Electric Car Registrations Continue To Steam Ahead In Europe With Some Massive Surprises

Saturday, 5. September 2020

Covid-19’s impact on the economy is not denting interest in electric vehicles (EVs), with record-breaking registrations in Europe in July.

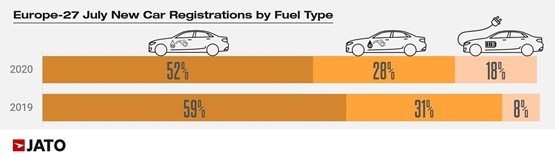

New analysis by Jato Dynamics shows that electric registrations, including hybrid and fully electric cars, were up 131% year-on-year to 230,700 – the first time it’s exceeded 200,00 units.

As a consequence, EVs accounted for 18% of total registrations in July, far greater than their market share of 7.5% in July 2019, and 5.7% in July 2018.

Felipe Munoz, global analyst at Jato Dynamics, said: “The rise in demand for EVs is strongly related to a wider offer that is finally including more affordable choices. The higher competition amongst brands is also pushing down prices.”

Half of the electric cars registered were powered by a hybrid engine (HEV), with demand soaring by 89%, with the mild hybrid versions of the Ford Puma and Fiat 500 contributing to this result.

Plug-in hybrid EVs (PHEVs) followed with 55,800 units, up by 365% from July 2019, helped by new models like the Ford-Kuga, Mercedes A class, BMW XC40 and BMW 3-Series.

Registrations for zero-emission battery EVs (BEVs) increased from 23,400 units in July 2019 to 53,200 a year later, and the offer increased from 28 different models available to 38.

New models like the Peugeot 209, Mini Electric, MG ZS, Porsche Taycan and Skoda Citigo helped drive demand.

TESLA DECLINE

However, Tesla posted a 76% decline to 1,050 units following shipping delays to Europe, as a consequence of production challenges in its Fremont, California plant.

Munoz said: “In contrast to the general trend of increasing demand for electric cars, Tesla is losing ground this year in Europe. Some of this can be explain by issues relating to the production continuity in California, but also by high competition from brands that play as locals in Europe.”

EUROPEAN CAR REGISTRATIONS

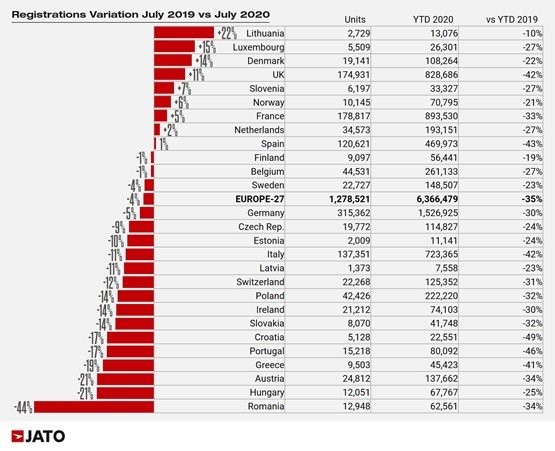

Jato’s data for 27 markets shows July saw the highest monthly volume figures so far this year – this also being the highest since September last year – with the industry registering 1,278,521 new passenger cars, down by only 4% month on month from 2019.

Munoz explained: “Both private and business consumers are responding to the better market conditions. If the current situation continues to improve, we could start to talk about a ‘V’ shaped recovery in the European car industry.

“However, there are still huge uncertainties regarding how and when the pandemic will finally come to an end, therefore caution remains.”

Volume levels since January fell by 35% to 6.37 million cars. However, demand recorded healthy figures in countries such as the UK, Denmark and France, alongside other small and midsize markets.

Much of this boost can be explained by an increased appetite for green cars, and more value offers, according to Jato.

Munoz continued: “The increasing demand predominantly favours SUVs, with a wider offering, including more electrified versions.”

SUV GROWTH

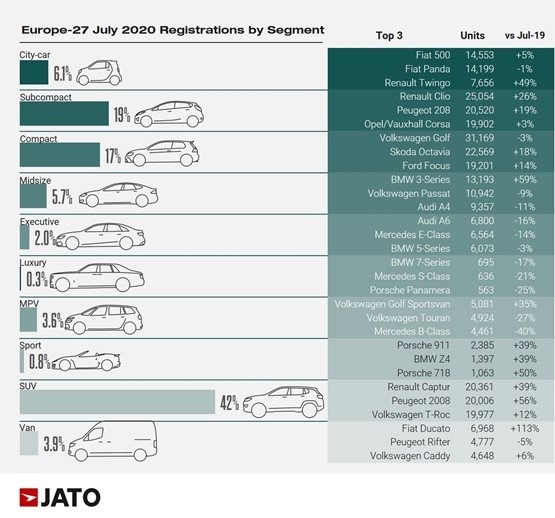

Last month, SUVs accounted for almost 42% of total registrations to 530,800 units, posting the highest monthly volume since July 2019.

“SUVs are usually more expensive than their car equivalents, so it is remarkable to see that despite the crisis, this is the only segment that has seen growth,” said Munoz. “They prove that with a competitive offer, consumers respond positively, despite the difficulties.”

Midsize SUVs were the only segment to record a decrease of 6%, a contrast to the positive results seen from small (up 9%), compact (up 4%) and large/luxury SUVs (up 14%).

At the same time, their demand has grown fast due to the electrification of many of the models available. In July, 48% of the electrified vehicles registered were SUVs.

VW GOLF REGAINS FIRST PLACE

The greater availability of the eighth generation Volkswagen Golf helped it regain first place in the rankings, that was previously lost in June.

However, it was not enough to offset the large drop posted by the seventh generation, as the average variation was negative. In contrast, the Renault Clio was able to record a 26% increase, as 89% of its volume corresponded to the latest generation.

The Skoda Octavia, Peugeot 208, Renault Captur and Peugeot 2008 also posted double-digit growth thanks to their recently launched new generations.

Other big improvers include the Hyundai Kona (up 56%), BMW 3-Series (up 59%), Mini Hatch (up 26%), Volvo XC40 (up 66%), BMW X1 (up 49%) and BMW 1-Series (up 52%).

The Renault Zoe and Kia Niro increased their registrations by 146% and 111% respectively.

Among the latest launches: Ford Puma (13,157 units at 24th position); Skoda Kamiq (8,736 units); Mazda CX-30 (5,494); Kia Xceed (5,201); Audi Q3 Sportback (4,183); Mercedes GLB (2,469); and Porsche Taycan (1,498).

VW GOLF REGAINS FIRST PLACE

The greater availability of the eighth generation Volkswagen Golf helped it regain first place in the rankings, that was previously lost in June.

However, it was not enough to offset the large drop posted by the seventh generation, as the average variation was negative. In contrast, the Renault Clio was able to record a 26% increase, as 89% of its volume corresponded to the latest generation.

The Skoda Octavia, Peugeot 208, Renault Captur and Peugeot 2008 also posted double-digit growth thanks to their recently launched new generations.

Other big improvers include the Hyundai Kona (up 56%), BMW 3-Series (up 59%), Mini Hatch (up 26%), Volvo XC40 (up 66%), BMW X1 (up 49%) and BMW 1-Series (up 52%).

The Renault Zoe and Kia Niro increased their registrations by 146% and 111% respectively.

Among the latest launches: Ford Puma (13,157 units at 24th position); Skoda Kamiq (8,736 units); Mazda CX-30 (5,494); Kia Xceed (5,201); Audi Q3 Sportback (4,183); Mercedes GLB (2,469); and Porsche Taycan (1,498). By Graham Hill thanks to Fleet News