Latest Car Registrations Show A Drop With Calls For More Incentives To Go EV

Thursday, 5. March 2020

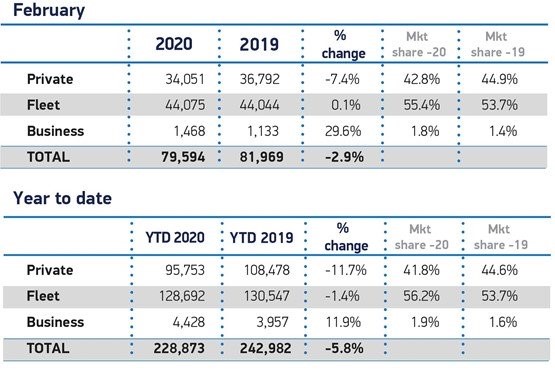

Fleet and business new car registrations fell slightly in February, when compared to the same month last year, according to data published today by the Society of Motor Manufacturers and Traders (SMMT).

There were 45,543 new cars registered to fleet and business in the month, an increase of about 1% on February 2019.

Year-to-date fleet and business new car registrations stand at 133,120 units, a 1% decline when compared to last year.

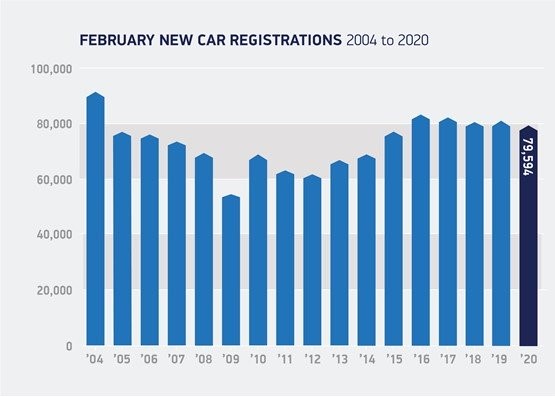

Overall, the UK new car market declined 2.9% in February, with 79,594 models were registered in the month. Registrations by private buyers were responsible for the bulk of the overall loss, down some 7.4% as 2,741 fewer people took delivery of new cars.

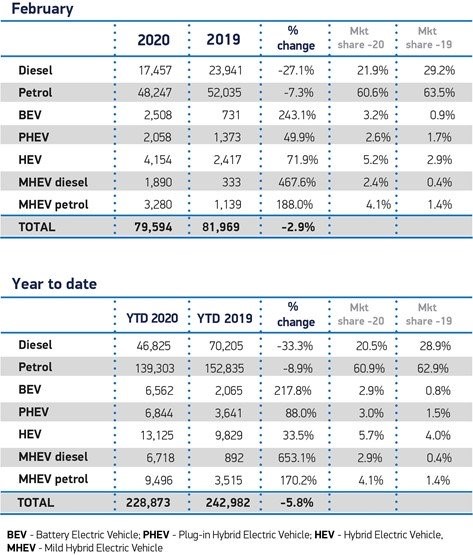

Demand for both diesel and petrol cars fell in the month, with registrations down 27.1% and 7.3% respectively, with diesel now accounting for just over a fifth of sales (21.9%).

Hybrids (HEVs) recorded an uplift of 71.9% to 4,154 units, while registrations of zero emission capable cars also continued to enjoy growth, with battery electric vehicles (BEVs) rising more than three-fold to 2,508 units and plug-in hybrids (PHEVs) up 49.9% to 2,058.

However, these vehicles still make up just 5.8% of the market; and BEVs only 3.2%, showing the scale of the challenge ahead.

The news comes as SMMT calls on the Chancellor to use next week’s Budget to announce bold new measures to make new-tech zero emission-capable cars, including plug-in hybrids, more affordable for mass market buyers.

In 2020, manufacturers will bring more than 23 new battery electric and 10 plug-in hybrid electric cars to the UK to add to the more than 65 already on sale, but take up of these new models depends on affordability and the provision of adequate charging infrastructure.

SMMT is calling for the removal of VAT from all new battery electric, plug-in hybrid electric and hydrogen fuel cell electric cars – a move which would cut the purchase price of an average family battery electric run-around by some £5,600.

Combined with additional measures, including the long term continuation of the critical plug-in car grant at current levels and its reintroduction for plug-in hybrids; and exemption from VED and insurance premium tax, the upfront cost of these vehicles could be cut by as much as £10,000, helping to deliver greater cost parity with conventionally powered vehicles and making them a viable option for many more buyers, it says.

Based on current market forecasts, SMMT calculations show that the removal of VAT could increase sales of battery electric cars alone to just under one million between now and 2024, resulting in an additional CO2 saving of 1.2 million tonnes over this period.

However, this must be part of a comprehensive package of incentives implemented alongside substantial investment in charging infrastructure to ensure a sustainable transition for consumers and businesses of all incomes, regions and lifestyles, it says.

Only by addressing both these issues can the government’s accelerated ambitions for zero emission vehicle sales be met.

Mike Hawes, SMMT chief executive, said: “Another month of decline for the new car market is especially concerning at a time when fleet renewal is so important in the fight against climate change.

“Next week’s Budget is the Chancellor’s opportunity to reverse this trend by restoring confidence to the market and showing that government is serious about delivering on its environmental ambitions.

“Industry has invested in the technology, with a huge influx of new zero- and ultra-low emission models coming to market in 2020, and we now need Government to match this with a comprehensive package of incentives and infrastructure spending to accelerate demand.

“To drive the transition to zero emission motoring, we need carrots, not sticks – as the evidence shows, talk of bans and penalties only means people hang on to their older, more polluting vehicles for longer.

“It’s time for a change of approach, which means encouraging the consumer to invest in the cleanest new car that best suits their needs.

“If that is to be electric, Government must take bold action to make these vehicles more affordable and as convenient to recharge as their petrol and diesel equivalents are to refuel.”

Michael Woodward, UK automotive lead, Deloitte, believes the key to maintaining growth of EVs will be investment in the supporting infrastructure.

“Where consumers were once deterred by battery range anxiety, this has now shifted to charging anxiety with access to charging now being seen as the biggest barrier to buying a full EV for UK customers,” he said.

“Manufacturers are doing their part by bringing new models to the market and adding range to batteries. What consumers need now is clarity on joined-up, long-term infrastructure development and continued financial incentives could be key to future EV growth.”

Jon Lawes, managing director at Hitachi Capital Vehicle Solutions, concluded: “The industry will be eagerly anticipating the Government’s Spring Budget next week, where further measures to support the transition to zero-emission vehicles are expected to be announced.

“As SMMT calculations have shown, the removal of VAT on electric and hybrid vehicles is one step that could support this transition, however, for any solution to be effective, clarity on considerations including Clean Air Zones, infrastructure investment and plug-in car grant incentives will also be pivotal to help achieve the UK’s zero emission targets.”

By Graham Hill thanks to Fleet News