FCA Approaching Debt Problems In The Wrong Way

Monday, 9. June 2014

I know I keep whinging on about the FCA and their new rules but I am genuinely worried about the affect it is having on the ability of lenders and intermediaries to do business and for genuine borrowers to be able to take out finance. As a result I’ve become pre-occupied with the subject of affordability and how lenders can analyse the application from a client to assess whether the customer should receive the finance or not.

Thinking of a change but unsure as to the best way to finance your car? Then you need a copy of my car finance book, Car Finance – A Simple Guide by Graham Hill. Click on the link below to buy the best car finance book on the market, available as a Kindle Book and Paper Back.

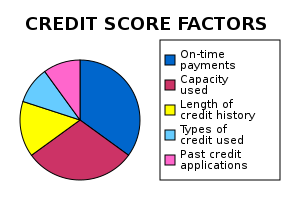

The problem that lenders have faced for years is – will the applicant make his repayments? The only way they have been able to assess this is by combining historical data with statistics to arrive at a pretty Heath Robinson credit score.

From the information obtained from the credit reference agencies combined with the lenders own score card requirements a further analysis takes place using statistics to arrive at an acceptance, decline or an acceptance subject to certain conditions or additional information.

For example if you are married with children in a house that you ‘own’ you are less of a risk and more likely to pay than a single person with no dependents living in rented accommodation. The fact that you own your house and have made your mortgage payments on time contributes towards your credit score but the fact that you are married with dependents is part of the lender’s score card. Now here is the confusion created by simply looking at your credit score.

Your credit reference agency score could be excellent because you have a credit card with a £2,000 limit on it that is paid on the button each month with a small balance on the card that every 3 months is fully paid off. All other payments are made on time including your mortgage which shows you own your property and you have no adverse whatsoever on the file.

But just because you have an excellent credit score doesn’t mean that you can afford to take out a finance agreement that will cost you £500 per month. You may show that historically you have met all your commitments and therefore represent a good credit risk but where is affordability in all this?

The lender’s own score card may show that having responsibilities, like a mortgage and children, living in a certain area in a certain job may statistically make you a good risk, there is nothing to prove it and I believe that it is this shortfall that has caused the Government via the FCA to force the lenders to test the ability to pay rather than the intention to pay.

But my question is this – if, through some twist of fate or luck the system worked – why try to fix it to the detriment of all concerned? We know that short term or pay day lending is a totally different type of product and given the distress that the collection and ability to rollover the debt, thereby substantially increasing the amount owed, causes consumers, it makes sense that lenders apply a more stringent set of affordability tests.

But that doesn’t apply to normal lending where the lenders have many years of experience under their belt and know who represents a good risk and who represents a bad risk. It’s a little like Ford identifying a problem with Focuses manufactured between 2010 and 2012 but recalling all Focuses ever made just to be on the safe side. It’s ridiculous.

In my simple opinion the ‘problem’ is being approached from the wrong end as I believe that generally most people have the intention to pay and have already personally checked the affordability of the finance out of their income. If someone dies in a car accident the Government doesn’t stop everyone from driving.

Lessons need to be learned, addressed and repaired to prevent it from happening again. The same applies to lending. But it already does. The lenders would soon go out of business if the number of defaults and arrears kept increasing so they are obviously refining their credit underwriting but even the lenders don’t have access to a crystal ball to see into the future.

The Government needs to spend money on helping those with debt problems, assist them in managing the debt and help them to recover with least pain to them and their family. When it takes two and a half years for the Financial Ombudsman to review a complaint it is clearly here that effort and money needs to be funnelled not into affordability checks that the lenders do quite adequately.

I ask the question again, what happens to those that wish to borrow money for a car in order to get to work or get their kids to school when the lender, after applying the new tests says no? The whole FCA concept has been ill conceived and badly thought through and for once it has nothing to do with the EU. By Graham Hill